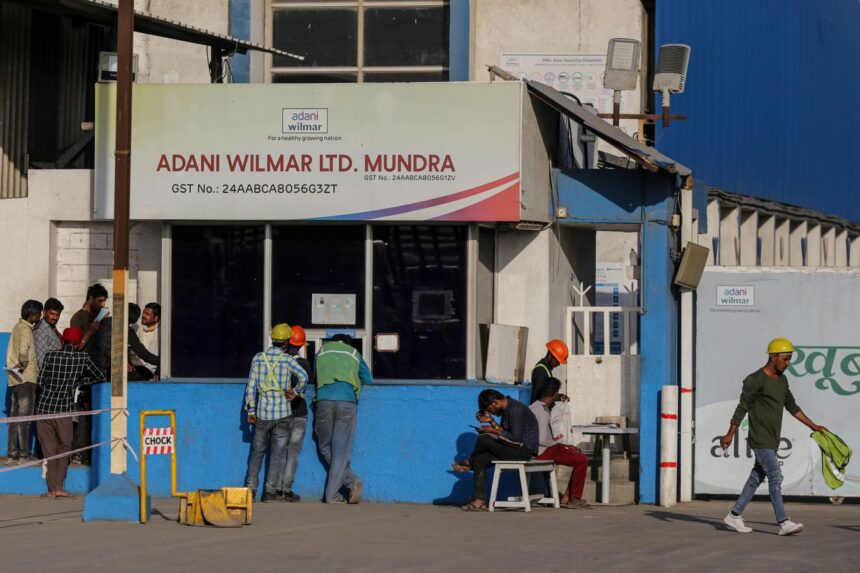

Adani Wilmar factory in Gujarat, India.

Adani Enterprises Ltd (AEL), owned by Indian billionaire Gautam Adani, is in a $2 billion multi-billion-dollar deal with partner Wilmar International, the Singaporean palm oil giant backed by Malaysian tycoon Robert Kuok. stage transaction to sell its entire 44% stake in Mumbai-listed Adani Wilmar.

Under the agreement, AEL said it will sell an initial 13% stake in Adani Wilmar to comply with the minimum public float required by Indian regulators, and sell the remaining 31% stake in the edible oil maker to Singapore-listed Wilmar International.

Gautam Adani’s flagship Adani Enterprises is exiting its joint venture with Wilmar to focus on its core infrastructure business and use deal proceeds to expand its renewable energy , transportation and logistics companies.

“AEL will continue to invest in the infrastructure space, which will further strengthen AEL’s position as India’s largest incubator of listed platforms that play key macro themes underpinning India’s growth story,” the company said in a statement on Monday. Adani Enterprises added said its board representatives will resign from Adani WIlmar, and Adani WIlmar’s company name will eventually be changed.

Together, the partners have a market value of about $5 billion, creating India’s largest consumer food manufacturer, with businesses spanning edible oils, oleochemicals and staples such as rice, sugar and wheat. Adani Wilmar has 100% urban coverage, operates in over 30,600 rural towns in the subcontinent and exports to over 30 countries across the world.

Listed in India in 2022, Adani Wilmar is one of more than 10 joint ventures owned and managed by Wilmar International. Kuok Khoon Hong, a global palm oil giant founded in 1991. Robert Kuok, who has an immediate net worth of $11.5 billion, owns a valuable stake in the commodities company, as well as interests in the Shangri-La hotel chain, real estate, shipping and logistics. Khoon Hong, chairman of Wilmar International, has a net worth of $3.8 billion.