Federal government resources stated India’s prominent state brain trust has actually recommended leisure guidelines advising extra analysis of Chinese financial investment.

The brain trust, referred to as Niti Aayog, stated the guidelines postponed some large offers, 3 federal government resources informed Reuters.

Presently, all financial investments by Chinese entities in Indian firms call for protection clearances from Indian houses and international divisions.

See additionally: Financial institution of America puts on hold traveling to China, and execs are outlawed from leaving

Resources that spoke with the media without permission and rejected to figure out stated brain trust Niti Aayog recommended that Chinese firms can get approximately 24% of their shares in Indian firms with no authorization.

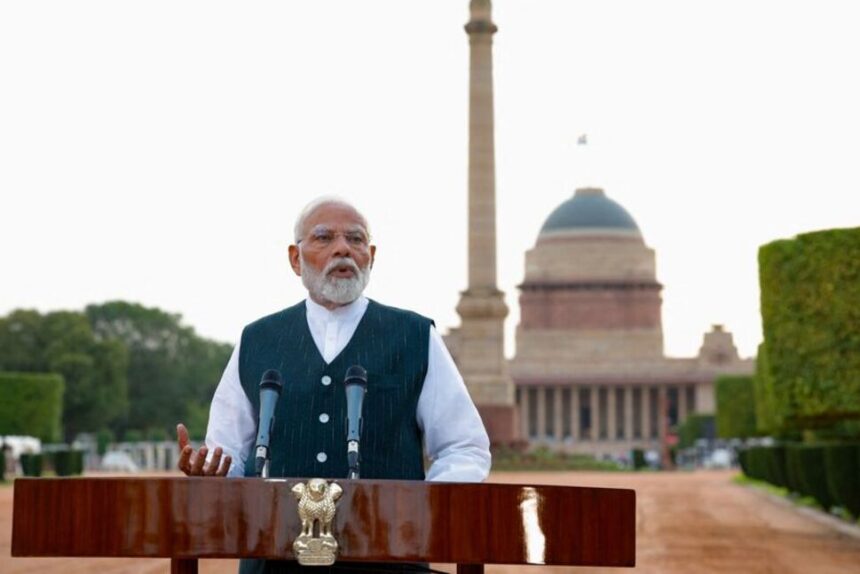

Resources stated the proposition was initially reported as component of a strategy to advertise international straight financial investment in India and is being researched in the Ministry of Profession, Ministry of Sector, Ministry of Financing and Foreign Matters, and the workplace of Head of state Narendra Modi.

Indian superpower attempts to dabble with connection

While not all Niti Aayog concepts should have been recommended by the federal government, the proposition remains in India and China Attempt to take care of a partnership that has actually been stressful given that the boundary dispute 2020.

Any kind of leisure choice can take months and will certainly be made by politicians, 2 resources stated. They included that the Ministry of Sector contributes to leisure, however various other federal government companies have actually not yet revealed their last sights.

Niti Aayog, ministries, ministries and the Head of state’s Workplace did not react to Reuters’ ask for remark.

After the boundary dispute, the policy was developed in 2020 and consists of a challenger in between 2 next-door neighbors.

They are just relevant to the biggest land boundary nations with Chinese firms. By comparison, firms from various other nations are cost-free to buy several fields, such as production and drugs, while particular delicate fields (such as protection, financial institutions and media) have constraints.

BYD recommends $1.1 billion

Resources claim that strategies such as Byd’s strategy to spend $1 billion in electrical lorry joint endeavors in 2023 result from these guidelines.

International financial investment has actually reduced internationally given that Russia’s intrusion of Ukraine, however policies that impede China’s financial investment in India are viewed as a crucial consider a sharp decrease in FDI in South Eastern nations.

Web international straight financial investment in India was just a document $353 million in the previous , a portion of the $43.9 billion signed up for the year finished March 2021.

Easing of armed forces stress given that October has actually resulted in even more initiatives from both nations to repair connections Strategies to return to straight trips India looks for “ Irreversible remedy” Their boundary disagreements for years.

Indian Foreign Preacher Subrahmanyam Jaishankar took a trip to China for the very first time in 5 years today and informed his peers that both nations should work out Stress on the boundary And stay clear of limiting profession procedures, such as China’s supply of unusual planet magnets.

The brain trust additionally advised an overhaul of the board of supervisors that selected FDI suggestions, resources stated.

- Jim Pollard’s extra editor Reuters