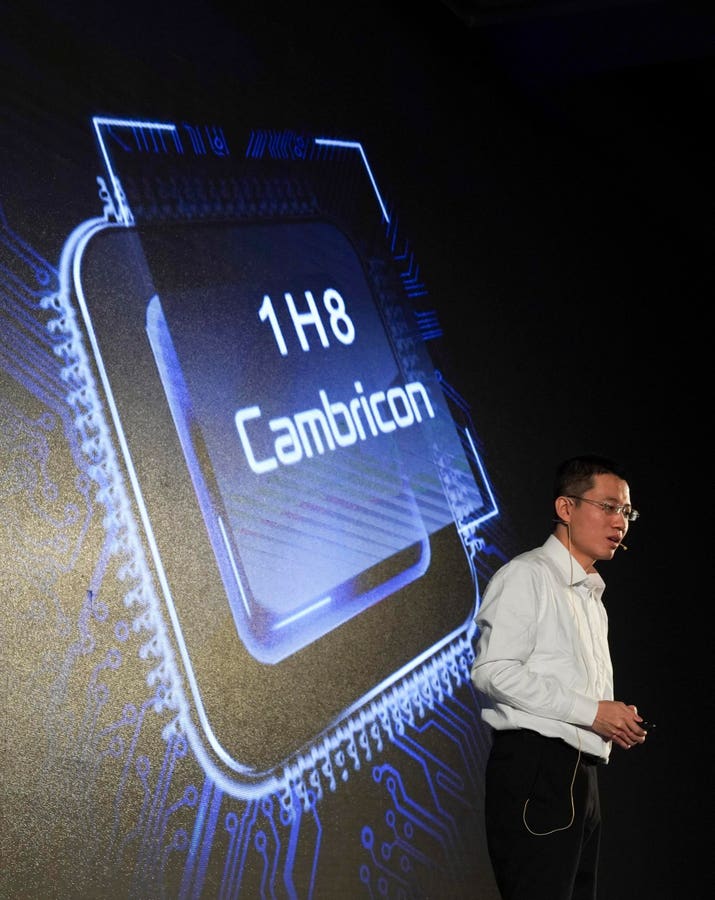

Chen Tianshi, founder of Cambrian Innovation, presented an expert system chip at a 2017 interview.

Xinhua Information Agency/Yin Gang Image resource: Getty Images

Chen Tianshi, founder of Chinese chip firm Cambrian Innovation, has actually seen his Shanghai-listed shares rise 500% in 2024 and his total assets skyrocketed to $10 billion, driven by China’s promote self-direction in innovation. Yet experts doubt whether his firm’s supply cost will certainly stay at such high degrees.

Since Jan. 15, the 40-year-old chairman and chief executive officer of Cambrian Technologies was the second-most beneficial firm on China’s Nasdaq-like Development Business Market, according to the most up to date information from the Shanghai Stock Market. When it got to 291 billion yuan ($ 40 billion). However after rising 7.3% in the very first 2 weeks of 2025, the supply dropped 17% on Thursday early morning prior to redeeming some losses to shut down 11.5% by lunchtime.

The decrease apparently came as Nvidia’s billionaire founder Jensen Huang got here in China’s technology center Shenzhen for a see. Shen Meng, Beijing-based handling supervisor of store financial investment financial institution Chanson & Co., stated on WeChat that his pleasant function was viewed as aiding Nvidia’s China service and damaging the rate of interests of neighborhood competitors such as Cambrian Innovation.

Huang is currently placed 10th worldwide th The wealthiest male with a total assets of $119 billion is withstanding the most up to date united state controls on chip exports Nvidia stated the constraints would certainly permit chip sales to a choose team of united state allies yet would certainly be harder for nations consisting of China. Russia’s acquisition of man-made intelligence-related chips can threaten united state management and injury international financial development. According to its yearly record, in 2024, 16.9% of the United States innovation titan’s US$ 61 billion in sales originated from landmass China and Hong Kong. He Sui, research study supervisor in Shanghai at research study company Omdia, stated by phone that Chinese web titans such as Alibaba and ByteDance are stockpiling their graphics refining systems (GPUs), a kind of AI-related chip utilized in AI advancement.

Some capitalists think Cambrian Technologies can eventually end up being China’s Nvidia. He stated residential firms’ market share in China’s expert system chip market will certainly remain to climb as stress in between China and the USA surge and Beijing urges using neighborhood innovation.

Cambrian Technologies is just one of minority neighborhood firms readily available for public financial investment. Chinese technology titan Huawei, likewise a personal firm, is likewise establishing chips. Both firms get on the united state federal government’s supposed Entity Listing, which limits their accessibility to united state innovation as a result of nationwide safety and security issues.

Cambrian Technologies has actually not reported a yearly revenue considering that its 2020 IPO, partially as a result of high research study costs, yet after today’s dive it still trades at a price-to-sales proportion of greater than 340 times. NVIDIA’s Nasdaq-listed share cost increased 150% in 2014, with a price-to-sales proportion of 30 times.

” Clearly, this is a huge bubble,” Dickie Wong, executive supervisor of research study at Kingston Stocks in Hong Kong, stated through text. “Capitalists are excessively hopeful concerning its AI service. Its appraisal shows up speculative and dangerous.”

Cambrian Technologies did not reply to duplicated ask for remark.

Natural born player Chen was confessed to the College of Scientific Research and Modern Technology of China in Hefei, Anhui District at the age of 16, and later on took part in research study at the Chinese Academy of Sciences and got his doctorate in 2010. According to neighborhood media records, he learnt computer technology from the very same college.

He has actually operated at the institute for virtually 10 years, where he started Cambrian Technologies in 2016. He left in 2019 to concentrate on Cambrian Innovation. The institute was a very early capitalist in the firm, holding a 16% risk, according to the Shanghai Stock Market.

Sunlight Wei, a Beijing-based elderly expert at research study company Counterpoint Research study, stated by phone that the firm hangs back Nvidia, which was started in 1993, in regards to technical stamina.

However she stated its items can be extra versatile, suggesting they can be tailored for certain usages in China. Cambrian Innovation stated in its 2023 yearly record that Chinese expert system start-ups Baichuan Expert system and HiDream.ai utilize its personalized semiconductors to create expert system designs. The firm has actually likewise enhanced its chips for usage in computer system vision and language handling at unrevealed neighborhood web firms, according to the yearly record.

According to initial outcomes reported by the Shanghai Stock Market, Cambrian Innovation anticipates sales to raise 69.2% year-on-year to 1.2 billion yuan in 2024. The firm stated losses would certainly tighten 53.3% from the very same duration in 2014 to 396 million yuan.

However whether it can stick out amongst residential competitors is one more inquiry. Paul Triolo, a companion at speaking with company DGA-Albright Stonebridge Team in Washington, D.C., stated it is in fact Huawei, not Cambrian Technologies, that has the very best possibility of overtaking Nvidia.

” Huawei’s Ascend 910X collection of GPUs are ending up being significantly effective and will certainly quickly match the efficiency of Nvidia A100 GPUs,” he stated in an e-mail. “Several of China’s leading GPU layout firms might accept or be taken in by Huawei to advertise far better GPU layout.”